Cook County Assessor’s Office Releases Final Chicago Reassessment Data Total value grows to $51 billion; homeowner share of tax base drops

Cook County Assessor’s Office Releases Final Chicago Reassessment Data

Total value grows to $51 billion; homeowner share of tax base drops

Cook County — The Cook County Assessor’s Office released data reflecting its final values in the City of Chicago for the 2024 reassessment.

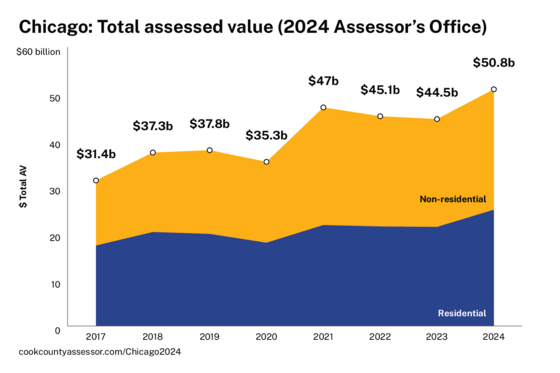

Following the 2024 reassessment cycle, total assessed value in Chicago is $50.8 billion. This represents an increase of $9.5 billion, or 23%, over total assessed values in 2023.

Because commercial property increased in value by more than residential property, homeowners saw their share of the tax base drop from 51% to 49%.

During a property reassessment, which takes place every three years, the Assessor’s Office determines the market value of property. This market value is then converted to an assessed value – usually, this level of assessment is 10% of market value for residential property and 25% of market value for commercial property.

Assessed values are used to calculate the tax base. The tax base, made up of equalized assessed values, is divided by property tax levies set by taxing districts, like schools and municipalities, to determine the tax rate. (Other factors, such as Tax Increment Financing, exemptions, the multiplier, and the “recapture” provision, also affect tax rates.)

When assessed values grow and levies remain constant, that can lead to a decrease in the tax rate.

Growth in market value of different property types can also change each type’s share of the tax base.

According to the Assessor’s Office, the assessed value of commercial property in Chicago increased by more than residential property values. Before the reassessment, homeowners held 51% of the share of assessed value in Chicago. Following the reassessment, that share dropped to 49%.

This decrease could result in a decrease of the average homeowner’s share of the tax burden.

The final effect on property tax bills depends on changes to levies, as well as other factors mentioned above. It also depends on the impact of ongoing appeal decisions by the Cook County Board of Review.

While the assessed value of both residential and non-residential property types grew, non-residential grew more than residential property.

“A strong market for multifamily apartments and industrial properties helped boost commercial property values in 2024, and offset more modest growth in the office sector,” said Cook County Assessor Fritz Kaegi. “The residential housing market also grew, but at a slower rate.”

"Because commercial property values grew at a faster rate, it ended up with a larger share of the overall tax base,” said Assessor Kaegi.

However, the Assessor’s Office is not the last word on assessments in Cook County. The Cook County Board of Review has the ability to change property assessments during its appeals process. The Board of Review’s appeals process for the 2024 reassessment cycle is ongoing.

In previous years, the Board of Review has granted significant reductions on appeal to commercial properties. This has shifted some of the tax burden onto homeowners. In last year’s reassessment of the south and west suburbs, Board of Review appeal reductions to commercial properties added four percentage points to homeowners’ share of the tax burden in that part of Cook County.

The typical residential tax bill in the south and west suburbs increased by 20% in 2024.

Data points: Chicago 2023 --> 2024

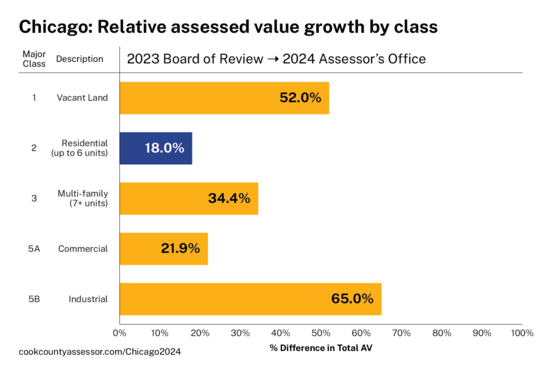

- Across the entire city, the two major property classes with the largest total growth were Class 3 multifamily and Class 5B industrial, which increased 34% and 65%, respectively.

- Class 5A, which includes office buildings, hotels, retail and other standalone commercial property, increased 22% from $14.3 billion to $17.5 billion.

- Class 2 residential property increased by 18%. (This reflects total growth in residential assessed values, not median or average changes.)

- In the three townships that include the city’s Loop area (North Chicago, South Chicago, and West Chicago), Class 5A property increased by $2.5 billion, or 21%, in assessed value.

More data is available through the CCAO’s website on the Data Dashboards. Data Dashboards are created by the Assessor’s Office to allow viewers to review assessments at each stage of the assessment process. In the first stage, the CCAO sets values and processes appeals. In the second and final stage, the Board of Review adjusts those values based on appeals filed in their office. The Dashboards provide a clear view of how the tax burden is split between residential and commercial property owners. They also show the burden shifts at each stage of the assessment and appeal process.

The CCAO has released Data Dashboards since 2020 for townships and municipalities within Cook County. To explore all the publicly available data, visit www.cookcountyassessor.com/dashboard.

Latest Stories

- ANOTHER STRONG HALF-YEAR RESULT FOR THE ILLINOIS LOTTERY

- Illinois State Rep. Introduces Legislation To Empower Young Voters

- Daughters Of Oscar Brown, Jr. Keep His Legacy Alive

- Simone Green Releases Single “Black Queen”

- Erie Family Health Center Opens The Sankofa Village Wellness Center

Latest Podcast

Get Your House In Order Legacy Plan