American Families’ Desire to Save For Their Children’s Future Increases During the Pandemic, According to New Research Survey

children’s future financial wellness, has announced the results of a survey that it commissioned focused on family savings through the pandemic. The survey, conducted by The Harris Poll and Caliber Intelligence on behalf of UNest, has shown that despite new financial strains from COVID-19, parents conclusively place their children’s future as their most pressing savings goal.

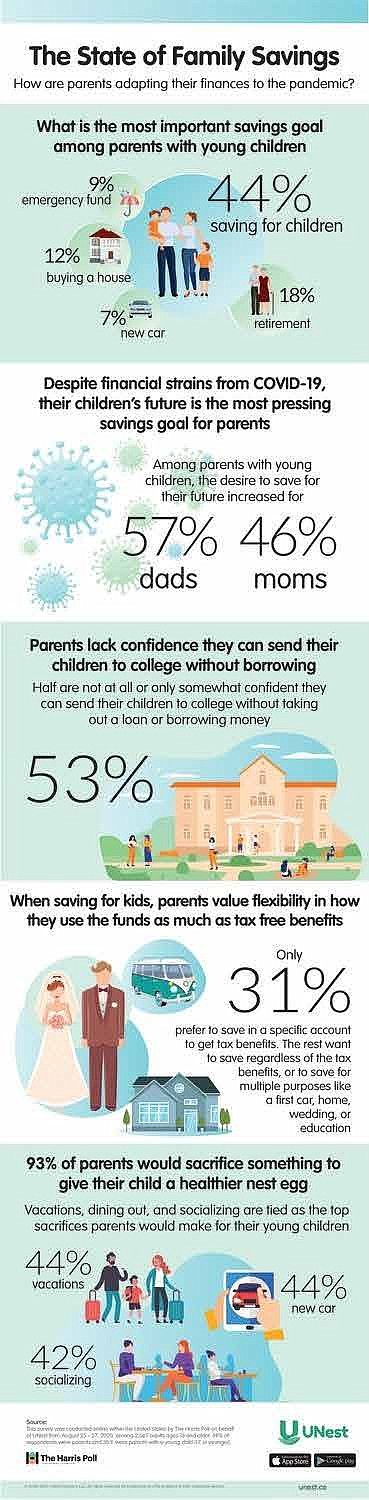

Among parents with children 17 or younger, 44% say if they could only

save for one thing in life, saving for their children would be their most

important savings goal. This was far ahead of the second choice of retirement, which was selected by 18% of the same group of parents. The delta between savings for children versus retirement was even wider for lower income families: for parents with children 17 or younger in lower-income households (<$50,000 annually), saving for children (49%) holds the largest lead over retirement (9%).

The survey also revealed the disparity between the genders on their confidence levels regarding saving for their child’s college education. Moms are more stressed about affording college than dads. One-in-four (26%) moms with young children (17 or younger) are not at all confident about affording college for their child(ren) without borrowing money or taking a loan, compared to 13% of dads. Conversely, 30% of dads feel extremely confident about affording college without debt, compared to only 13% of moms.

Relative to the pandemic, half (51%) of parents with young children (17 or younger) indicate that COVID-19 has increased their desire to save for their children’s future. This desire is led by dads (57%) over moms (46%).

In recognition of how pandemic has increased the desire of parents to

save, and in line new year resolutions for families, customers that sign up for a new UNest Investment Account for Kids by the end of February will also receive $25 from UNest to kickstart their family’s savings plan. When they visit: https://unest.co/nyresolution/

The survey also identified that parents value having flexibility in how they use the money they save for their children’s education at an equal level of importance as the tax saving associated with college saving plans.

In particular, moms (37%) are significantly more likely than dads (24%) to prefer flexibility in use of funds to ensure they can use it for multiple

purposes over education specific taxfree savings. In contrast, dads (42%)

are more likely than moms (21%) to prefer saving for their child’s education

in a specific education fund, but only if it is tax-free.

The survey revealed that vacations, new cars, dining out and socializing

are the top sacrifices parents would be prepared to make if it meant their child would have a healthier savings nest egg. Close to half of parents with

a child 17 or younger would give up vacations or buying a new car (both at

44%), roughly tied with the 42% that would give up dining out or socializing

if it would help secure their children’s future. In general, the overwhelming

majority (93%) of parents with kids under 17 are willing to make a self-sacrifice if it means their child would have a healthier financial future.

The parents of young children also responded positively about receiving

monetary gifts for their children rather than toys, clothes, and other gifts. Nearly half (47%) of parents with young children say a contribution to their child’s college savings account is a valuable gift from family members and

friends. The desired financial gifts that parents value include cash/gift cards (65%) or financial investments (i.e., contribution to college savings account

& stock or other investments (61%).

“The survey supports our core contention that young parents place their

kid’s future needs far ahead of any other saving goals,” said Ksenia Yudina, chief executive officer and founder of UNest. “Alongside the Harris/Caliber research, we conducted a survey of UNest customers and identified that since opening an account, the majority (51%) of UNest parents are more confident about their ability to afford their child’s college. Together, the results of the surveys show that American families have responded to pandemic-related economic volatility by aligning their priorities towards their children.”

The results of the UNest/Harris Poll are consistent with the 2020

Planning & Progress Study conducted by Northwestern Mutual. This survey identifies that nearly three out of 10 (28%) Millennials have revisited their plans and made significant adjustments because of the pandemic, more than any other generation. The 2020 Planning & Progress Study also points to the fact that 29% of Americans work with a financial advisor and 65% do not. Previous studies by Northwestern Mutual have shown that U.S. adults who work with a financial advisor report “substantially greater financial security, confidence and clarity than those who go it alone.”

Latest Stories

- ISBE and Lurie Children’s Launch Free, Data-Informed Resilience-Supportive Schools Illinois Initiative to Strengthen Student Mental Health and Resilience in All Schools

- Alzheimer’s Association Illinois Chapter Strengthens Commitment to Health Equity Through Diversity and Inclusion Initiatives

- Actress Draws From Life Experiences For Music And Acting Preparation

- Former Journalist’s Fragrance Company Promotes Self Care

- Doctors Provide Information About Resources For Women Experiencing Menopause

Latest Podcast

STARR Community Services International, Inc.