LEGISLATION INTRODUCED TO PROVIDE TECH ACCESS FOR LOW-INCOME STUDENTS

Legislation introduced to provide tech access for low-income students

BY TIA CAROL JONES

With COVID-19 causing school districts across the country to move toward remote learning for the rest of the school year, students without computers or internet access would miss out on critical learning opportunities.

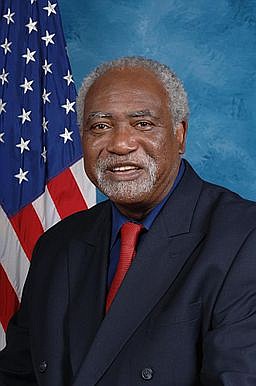

To combat this, Congressman Danny K. Davis, D-Dist. 7, introduced the Computer and Internet Access Equity Act.

The legislation would amend the Internal Revenue Code of 1986 to provide a $10,000 lifetime tax credit for low-income and moderate income families to purchase computers and other equipment for educational purposes.

It would also modify requirements for the Federal Communications Commission’s Lifeline program to provide increased support for broadband internet service, as well as provide grants for non-for-profits to give internet safety instruction.

“These huge gaps exist in healthcare, but also in terms of economics, education and all of the positive aspects of life,” Davis said. “The primary way of getting [a] formal education is through the use of technology, computers, broadband, internet. If you’re low-income and don’t have a computer, and you’ve got to have one to go online to be in class or to do what’s necessary, then you’re actually left out.”

Davis said the goal of the legislation is to reduce the digital poverty divide and create the opportunity for low and moderate-income young people, as well as older people, to have access to computer equipment needed for them to compete and to be able to participate in distance learning. The tax credit would be available to families who make less than $70,000.

“In this country, poverty, poor people, low- income people have always had a hard time, but they’re having an even harder time,” he said. “If you’re receiving SNAP benefits, the chances may be pretty good that you don’t have enough money or enough resources to purchase your own individual computer. So, how do you learn, how do you go to school?”

According to the Pew Research Center, while 58 percent of eight graders in the United States use a computer to complete their homework, low and moderate-income, as well as minority students, use cellphones, public wi-fi, or are unable to do their homework. It also showed that 17 percent of United States teens are unable to complete their homework at all. It is often referred to as the digital homework gap.

Davis said he and the other Congressmen and Congresswoman who signed onto the legislation, are excited about it, adding the legislation will enable students to be able to compete with other students who have more resources and who come from families with higher incomes.

This goes beyond the coronavirus pandemic, Davis said. Even when the virus is arrested and once the virus poses less of a threat than it does now, “low income people still need access to the technology age,” he said. “And, if you don’t have money, you don’t have a job, you’re unemployed, one of the best ways we think you

can get this equipment is to use the tax credit we’re talking about.”

Latest Stories

- ISBE and Lurie Children’s Launch Free, Data-Informed Resilience-Supportive Schools Illinois Initiative to Strengthen Student Mental Health and Resilience in All Schools

- Alzheimer’s Association Illinois Chapter Strengthens Commitment to Health Equity Through Diversity and Inclusion Initiatives

- Actress Draws From Life Experiences For Music And Acting Preparation

- Former Journalist’s Fragrance Company Promotes Self Care

- Doctors Provide Information About Resources For Women Experiencing Menopause

Latest Podcast

STARR Community Services International, Inc.